TTR In The Press

Consultancy

June 2018

M&A forecasted to slow in unstable Latin America political climate in 2018

The first quarter of 2018 has seen a fall in mergers and acquisitions in Latin America in comparison to the same period the previous year. The region suffered due to political instability and economic woes, which are creating an atmosphere of uncertainty for investors.

Latin America’s three largest economies are experiencing turbulence in the first quarter of 2018 due to elections in Mexico and Brazil, as well as a rapidly declining peso in Argentina. The region has shown 12.4% less M&A activity year on year between January and April. Instability in the three Latin powerhouses is the root cause of the lack of investor interest according to a Transactional Track Record (TTR) report.

"This year is a period of key elections, not only in Brazil, but throughout Latin America, which generates an atmosphere of uncertainty in the investment environment, and which consequently affects to some extent the dynamics of the mergers and acquisitions market," said TTR’s Latin America research and business intelligence analyst, Marcela Chacón.

A recent report by law and consulting firm Baker McKenzie identifies that whilst the M&A sector got off to a slow start in 2018, the outlook is still optimistic for investors. The report titled ‘A buyer's guide to M&A in Latin America’ identifies investor outlooks for 2018 and hurdles which will keep investors away from closing deals. One of the main findings of the report is that the current situation in Latin America creates a positive environment for M&A activity, but instability is one of the most pressing issues in the largest Latin economies.

Mexican elections

In the lead up to Mexico’s 2018 presidential elections, the country has experienced its worst period of political violence in recent history. The country is looking to the left-leaning Andres Manuel Lopez Obrado to solve outstanding economic and security issues. Lopez Obrado, according to a recent opinion poll, is leading the race with 52% of the popular support.

However, businesses around the country fear that turning to a populist president puts the country in danger of ruin. Mainly citing Cuba and Venezuela, the recent economic issues in Argentina, and – to a lesser extent – the past leftist leaders of Mexico , critics of Lopez Obrado have issued warnings about turning down the populist road.

"If this populist economic model, in which everything supposedly belongs to and comes from the state, and in which people are given things without working for them, ends up being imposed on Mexico, investment will be disincentivized, seriously affecting jobs and the economy," stated a letter by the head of mining and rail company Grupo Mexico and Mexican billionaire German Larrea.

Brazilian elections

In Brazil, two decades of economic and political instability have influenced investors to hesitate in injecting capital into the country. As the country has recently returned from recession, this year's presidential election marks the pinnacle of economic reform and will decide the future of the country’s ability to attract FDI.

Whilst the Brazilian economy expanded in the first quarter of 2018 – upholding a run of 5 straight quarters – investors are still weary of the next Brazilian presidents ability to curb a growing budget deficit. The October election which has been dubbed the most important election since the country’s re-democratization, will underpin Brazil’s economic outlook.

“Putting Brazil on a sustained growth track will not be an easy task for the next administration, as it will have to lead an important agenda of structural changes, amid a fragmented political system, ” stated a Rabobank report on the matter. “Another alternative scenario is no goodwill nor room for reforms, taking Brazil CDS to levels similar to those in late 2015 – when the country lost the investment grade status.”

Argentina economic crisis

Reforms in Argentina have not been enough to stabilize the country’s fragile economy. Argentinian President Mauricio Macri has recently engaged in talks with the unpopular IMF – in 2001, the country defaulted on $132 billion worth of foreign debt, leading to the IMF to cut off financial support – which is a political gamble amongst Argentinian voters. The move has shrouded the political future of the centrist-right government – who will be seeking reelection next year – in doubt.

"Argentina is still a difficult country and unless they do reforms then it's going to be having issues," said Michele Gesualdi, the chief investment officer at Kairos Investment Management. "There was a lot of excitement involving (President Mauricio) Macri, and frankly we were involved for example in the first two years. But then the risk reward wasn't very compelling in fixed income, it was a bit better in equities, but increasingly over the last few quarters Macri has been disappointing investors in terms of not doing the reforms he promised.”

Baker McKenzie M&A outlook 2018

Whilst 2018 may have begun on the rocks for FDI in Latin America, the region is still attracting sustained interest, especially from China. In the recent report, Baker McKenzie surveyed a number of foreign investors who had completed deals in Latin America in the past three years to better understand the forces shaping M&A trends in individual markets.

Whilst the survey focuses on foreign investors in the consumer goods, technology, healthcare and financial services, it also highlights the shift away from investments solely in the energy sector and the perceived opportunities that stem from Latin America's expanding consumer base, rapid market growth and low cost of doing business.

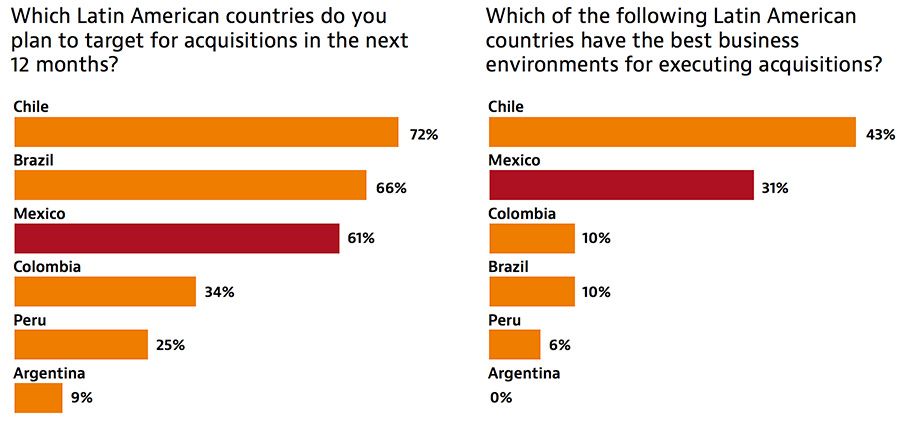

Due to the political instability in the three major Latin economies, the Baker McKenzie report suggests that other nations will be the basis of future investment. Chile has emerged as the frontrunner for future deals due to its strong rule of law and low levels of institutional corruption. Colombia is also a rising star in the M&A sector after low awaited tax reforms in 2016, and as the peace process draws nearer to a conclusion.

Whilst the region has long been plagued by political instability and economic challenges, it continues to attract investments and see incremental M&A activity. The report states that over 80% of dealmakers who responded to the survey expect an increase in activity in the sector throughout the 2018 period.

Despite the rocky start and providing that regional governments retain their pro-business, pro-growth stances, Latin America will continue to provide investors with a lucrative and largely optimistic future investor playing field. "The economic and political volatility in our region has been a major force in creating good opportunities for investors," said Liliana Espinosa, chair of Baker McKenzie's Latin America M&A Practice.

Source: Consultancy - Argentina